Case Study

Automate income and expense verification using documents

How this lender automated income document reviews to accelerate loan approvals.

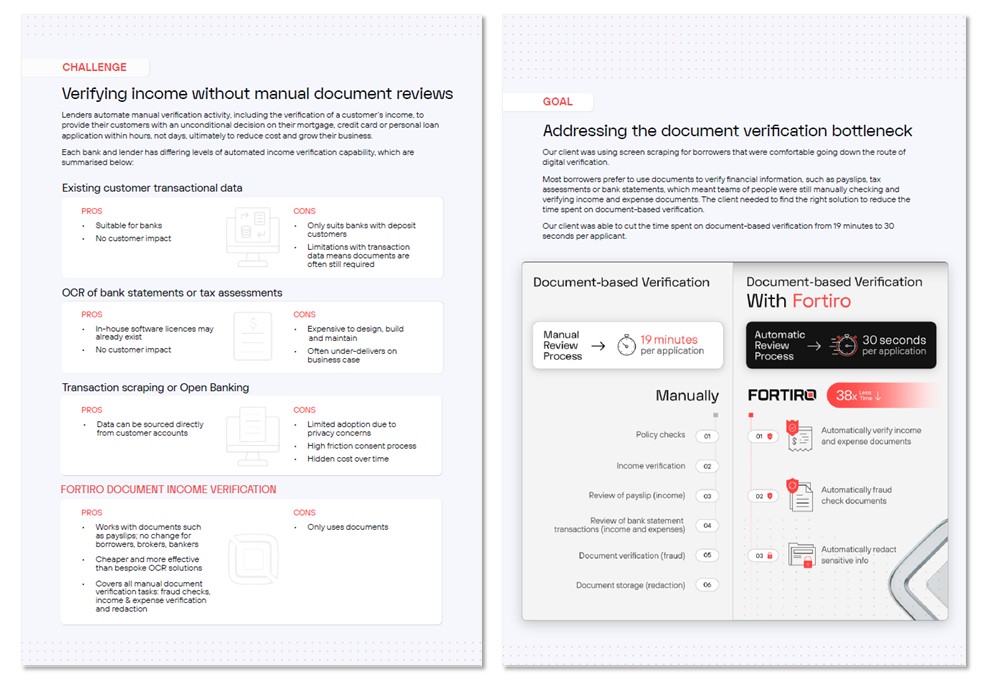

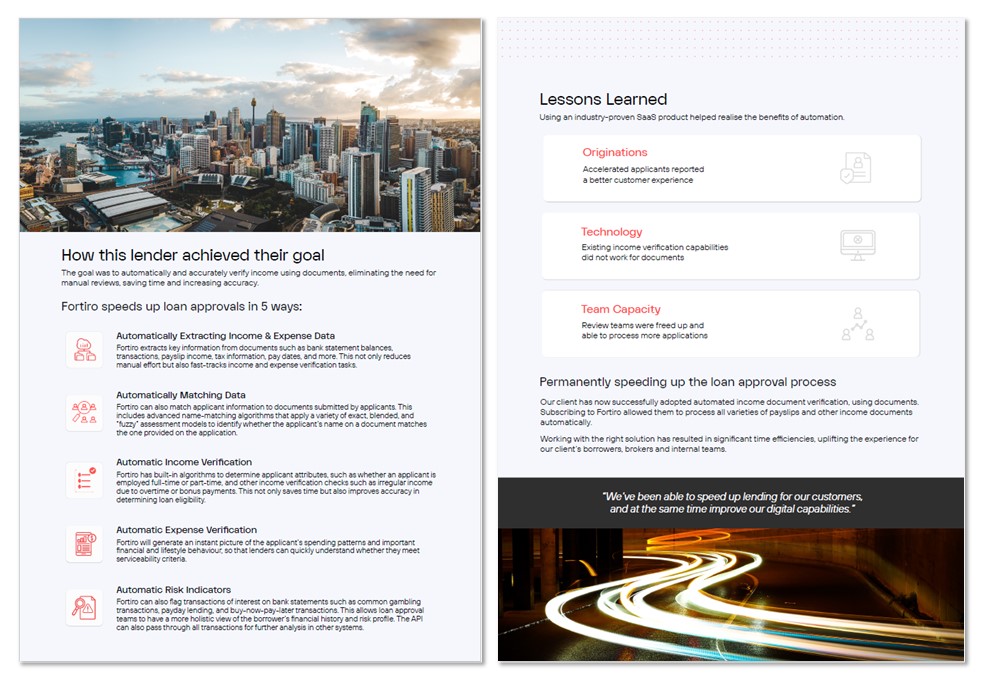

Borrowers provide payslips and other financial documents as proof of their income and expenditure when applying for a loan. These documents are then manually reviewed before the loan is progressed.

This manual review has proven to be time-consuming and costly - and a key blocker to providing customers with a fast, unconditional decision on their application.

In response, lenders increasingly turn to technology to eliminate this bottleneck, using tools that can automate income and expense verification. Lenders are automatically reading the information from payslips, bank statements and other financial documents from both assisted (such as in a branch, or through a broker) or unassisted (such as an online application) channels, in a range of file formats, to speed up unconditional decisions.

Get a demo today

Get a demo of Fortiro’s income document verification platform to see how it can help you.